AI is being applied in several aspects for the clinical trial process today. From analysing real-world data and scientific information, to providing improved patient stratification and predictive outcomes, and assisting with different aspects of clinical trial operations. In this article, we will present some of the technologies using AI and machine learning in the clinical trial space today, outlining how they fit within the clinical trial ecosystem and discuss the impact on future clinical trial designs.

The Diversity in AI Solutions for Clinical Trials

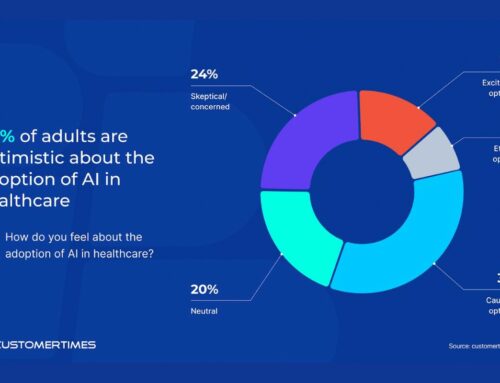

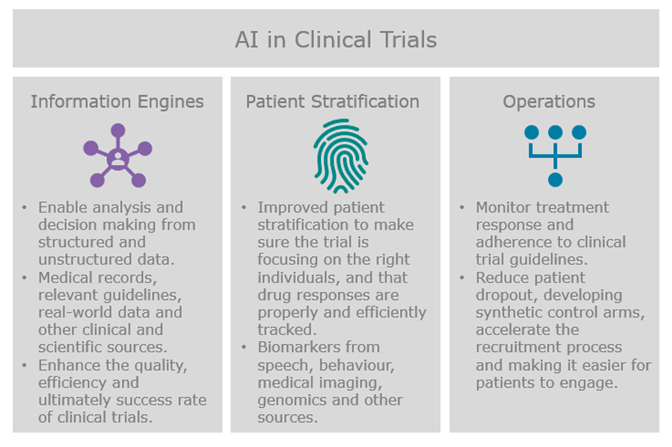

Clinical trials are an area with great potential for optimisation; only 12% of drug development programmes ended in success in a 2000-2019 study according to recent research . Inability to demonstrate efficacy or safety, flawed study design, participant drop-outs or unsuccessful recruitment all contributed to the low success rate of clinical trials. Vendors active in this field are therefore focusing on use of AI-based software in three main areas: information engines, patient stratification and clinical trial operations.

Information Engines

In the first group we typically see vendors using Natural Language Processing (NLP) to enable analysis and decision making from structured and unstructured data from medical records, relevant guidelines, real-world data and other sources. The goal in aggregating and mining disparate sources is to potentially enhance the quality, efficiency and ultimately success rate of clinical trials. Some of the players in this field include IBM Watson, Innoplexus, Aetion, Concerto HealthAI, Owkin and GNS Healthcare. IBM Watson is basing their capabilities around their clinical trial management software and using AI to improve clinical trial matching and enrollment particularly for oncology trials. Aetion analyse medical and pharmacy claims to understand which treatments work best for which patients and at which times. Concerto HealthAI extract insights from oncology patients experiences with drugs to generate evidence for new therapeutic approaches, and GNS Healthcare help to identify subpopulations with unmet needs, identify patients likely to be responders to the drug, and after the trial identify subpopulations that should receive the drug as first and second line therapy. Information engines are often working across drug discovery and clinical trials providing valuable information to both sides of the drug development process. Within clinical trials, these information engines are also integrated with wider clinical trial design and operations, as well as guiding decisions towards better patient stratification.

Patient Stratification

Clinical trial design and optimisation often comes down to improved patient stratification to make sure the trial is focusing on the right individuals, and that their drug responses are sufficiently tracked to be able to efficiently draw conclusions from the trial. Several technologies are supporting these efforts. Vendors like nQ Medical and WinterLight Labs are using speech biomarkers and patient interactions with electronic devices and touchscreens to quantitatively detect and track progression of neurological disorders during clinical trials. This enables more automated classification of patients with disease by determining individual components and characteristics associated with disease severity.

Other vendors like VIDA, Perspectum, Quibim, IAG and IXICO are using machine learning based medical imaging analysis to identify disease from radiology images and track clinical efficacy during the trial. The benefit here is that imaging biomarker endpoints are already well established and used throughout the pharmaceutical industry, so little persuasion is needed with regards to usability of the technology for common disease areas. Although still relatively early compared to in radiology, AI-based Image analysis is also used in pathology where vendors like Reveal Biosciences and PathAI use histopathology for patient stratification and disease sub-typing in clinical trials.

Further, other vendors are focusing on the use of DNA sequencing and genetic biomarkers to identify patients with more severe disease cases and then subtype the patients more finely and associate these with treatment responses during the trial. WuXi NextCODE and Tempus Labs are some of the more established vendors in this field who have built these capabilities on top of their DNA sequencing service businesses and population sequencing projects.

Clinical Trial Operations

AI is also being applied to the operational side of the clinical trial process. AiCure and Brite Health are using AI to monitor how patients respond to treatment during clinical trials using visual and audio data to determine if the treatment is working, and to increase adherence to trial procedures and reduce patient dropout. The San Francisco based start-up Unlearn.ai is trying to reduce the number of subjects required for clinical trials by using digital twins as synthetic control arms for a proportion of the placebo controls. This reduces the resistance from patients enrolling to the trial by reducing the risk of being assigned placebo and minimising the number of participants needed to complete a trial.

More directly involved in the clinical trial recruitment process are vendors like Trials.ai, Antidote.me and Deep 6 AI, who develop AI applications that accelerate the recruitment process by making it easier for patients to enroll and engage, or analyse medical records and relevant information to identify more patients suitable for a specific trial.

The New Ecosystem in Clinical Trials

The emergence of AI and new technologies is greatly changing the clinical trial ecosystem. Fueled by the need to reduce costs and improve the efficiency and success rate in clinical trials, a whole new breed of technology providers have entered an arena that was previously exclusive to pharmaceutical companies and CROs.

CROs still provide the expertise and network necessary to run a typical clinical trial, but are in some cases seen as both a partner and a competitor for these new AI-software entrants, particularly for larger firms already able to run the trial through their own network of clinical partner sites. AI technology vendors are most commonly working directly with the pharmaceutical company sponsoring the trial, optimising the trial using own de-identified data collated directly from hospitals and academic centres, and in many cases additional enterprise clinical trial data from the sponsor. The AI vendor then collaborates with the assigned CRO in executing the trial.

Data management firms specialising in extracting and de-identifying data are entering the ecosystem as a link between AI start-ups and data sources. These vendors include InterSystems, LifeImage, Medexprim, Segmed and other interoperability specialists offering a faster and easier way to obtaining training data sets and connecting with pharma companies’ enterprise data.

Large technology firms are also an integrated part of the clinical trial ecosystem. AWS and Google provide their cloud hosting services to many AI start-ups, but Microsoft and Google are also working directly with pharmaceutical companies to build AI capabilities around the massive amounts of enterprise and clinical trial data often stored at these companies. Nvidia is providing its GPU hardware solutions to pharma, biotech and healthcare technology vendors including AI start-ups, but are also providing specialised solutions and application frameworks for genomic and medical imaging data analysis, as well as offering incubator programs for promising AI start-ups.

As the diversity in technologies and the complexity of the ecosystem increases, will there be a need for consolidation and simplification of the supply chain? Will each individual technology provider continue to work directly with the sponsor, or will CRO’s increasingly organise the workflow and orchestrate the stakeholders ?

Most CRO’s are still hesitant to engage with AI start-ups at this early stage, but we are starting to see some partnerships created where CRO’s use AI technologies as a differentiation factor for new deals. This will simultaneously ease the go-to-market strategy for start-ups. As total investment in AI for drug development & clinical trials has now passed $5.2B and many partnerships have already been established between AI start-ups and pharmaceutical companies, CRO’s will soon be looking to leverage AI-based technology to ensure they remain a central player in the clinical trials process; in the near term through a combination of partnerships and start-up support, and in the longer term through more integrated solutions.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

About The Author

Dr. Ulrik Kristensen is a Senior Market Analyst at Signify Research with 8 years’ experience from the healthtech industry. Ulrik is part of the Healthcare IT team and leads the research covering Drug Development, Oncology and Genomics. Ulrik holds a MSc in Molecular Biology from Aarhus University and a PhD from University of Strasbourg. He can be reached at ulrik.kristensen@signifyresearch.net.

More Information

To find out more:

E: ulrik.kristensen@signifyresearch.net

T: +44 (0) 1234 436 150