By Sanjay Parekh, Analyst at Signify Research |

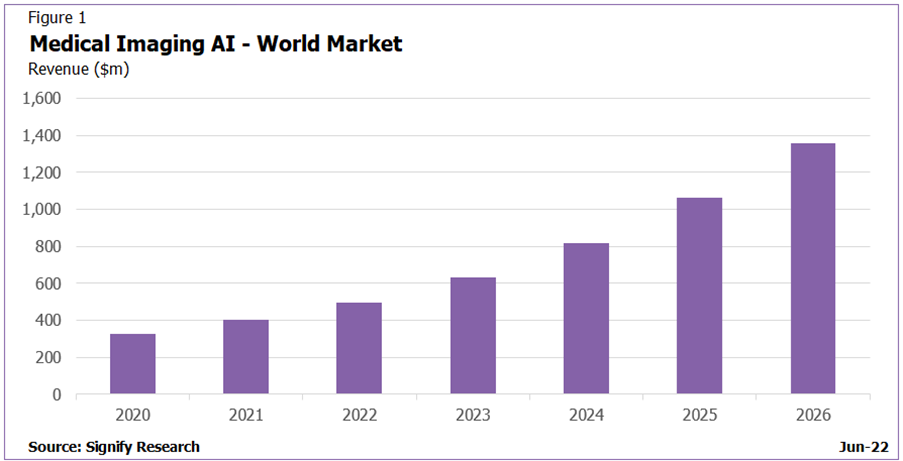

The medical imaging AI world market has surged past pre-pandemic levels and was estimated to be more than $400 million in 2021, an increase of more than $60m compared to the previous year. This market remains in development and despite several major barriers that need greater attention, the market is forecast to reach almost $1.4 billion by 2026, with a growth rate (CAGR) of 26.7% (2020-2026), as reported in Figure 1.

Figure 1: The Medical Imaging AI World Market – Market Size (2020 and 2021) and Forecast (2022– 2026)

Crossing the Chasm

Radiology AI adoption is on the cusp of ‘crossing the chasm’ towards widespread use in radiology. New product launches (on the back of a fast-growing number of regulatory approvals), including enhancements to existing solutions (e.g., adding triage capabilities to detection-only tools), or vendors expanding product portfolios (across new clinical segments) have continued to drive market momentum.

Vendors are also evolving their offerings from single-point algorithms to AI solutions in several ways. These include:

- Comprehensive solutions(e.g., chest x-ray solutions from Annalise.ai, Qure.ai, Oxipit),

- End-to-end solutionsfor time-critical use cases (e.g., stroke imaging AI solutions from Viz.ai, RapidAI, Aidoc), or

- Workflow suites(e.g., Arterys’ body area suites or Agfa HealthCare’s RUBEE workflow packages centered around given application use cases).

The Driving Forces

The market has also seen ongoing venture capital investment, with the balance tipping towards larger, later-stage funding rather than small, early-stage funding. Earlier in 2022, Signify Research coined the ‘$100m Club’ of vendors that have raised more than $100m in VC investment, but a more exclusive group (vendors that have raised more than $250m) has suddenly emerged.

Other market drivers include an increasing number of regulatory approvals in China (Class III NMPA approvals) and the emergence of new solutions (AI platforms) from both AI independent software vendors (ISVs) and imaging IT vendors. AI platforms aim to address the last-mile challenges of deploying, integrating, and orchestrating AI to enable healthcare providers to adopt radiology AI at scale.

Segmentation of the Market

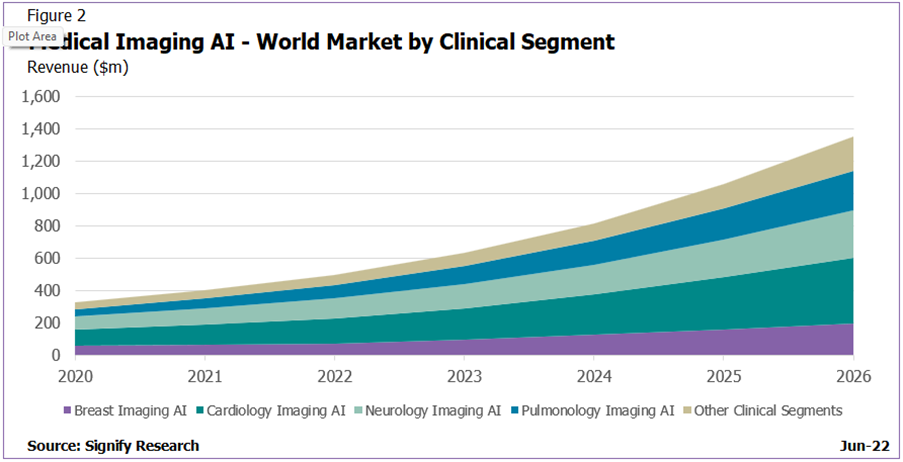

Figure 2 shows the world market forecast by clinical segment. Most products available in the market today target the four main clinical segments (87% of market revenue in 2021), namely:

- Cardiology(primarily cardiac CT solutions, including FFR-CT),

- Neurology(mainly stroke solutions, including both large vessel occlusion and intracranial hemorrhage),

- Breast imaging (breast CADe and breast density analysis),

- Pulmonology (primarily chest X-ray and chest CT, including lung cancer)

Figure 2: The Medical Imaging AI World Market by Clinical Segment (2020 – 2026)

73% of solutions available in the market are stand-alone AI solutions, typically from AI ISVs, whereas imaging IT vendors tend to favor partnerships to deploy AI. However, some of the larger imaging IT vendors are developing their native AI portfolios rather than leaning towards third-party partners as they scale their AI offerings.

As the market matures, the balance between stand-alone AI solutions and AI tools on advanced visualization (AV) platforms (“AV-bundled AI tools”) will shift even more towards stand-alone AI solutions. These solutions will account for 88% of the global market in 2026, despite a healthy growth rate (CAGR of 7.8%) for AV-bundled AI tools.

Barriers Hampering Market Growth

Despite the optimism, the medical imaging AI market faces several barriers. One of the most significant barriers is the lack of reimbursement, especially beyond the US. However, the recent CPT codes announced by the CMS for quantitative imaging tools (for population solutions), which may become reimbursable in the US, indicates this will change. It may also lead to other regions investing in AI at scale.

Clinical validation studies, which address the efficacy of algorithms, are increasingly being published. However, there remains a lack of large-scale studies reporting on the health economics and return-on-investment for medical imaging AI solutions.

Other macro-factors may also prevent the market from reaching its true potential. The European Union (EU) Medical Device Regulation (MDR), which comes into effect in May 2024, may result in the medical imaging AI market in Western Europe stagnating as vendors without MDR will have to cease business.

Further, global headwinds, such as geopolitical tensions, the looming global recession, and a focus on other priorities for healthcare providers (e.g., dealing with the aftermath of the Covid-19 pandemic) and imaging IT vendors (e.g., a shift to enterprise imaging, or cloud adoption) may also curtail the growth of the medical imaging AI market.

Conclusion

Medical imaging AI vendors should continue to tackle these market barriers to remain competitive. Although current market drivers help the case for AI, vendors should ensure their solutions deliver value to the radiologist beyond point algorithms and may consider multi-ology or multi-modality approaches. Solutions that improve individual patient care and population health will stand the test of time and ultimately account for a significant proportion of this soon-to-be billion-dollar market.

About the Report

“AI in Medical Imaging – Market Intelligence Service – World – 2022” provides regular data, insights and analysis on the global market opportunity for AI-based medical image analysis. The five deliverables included in the 2022 subscription are:

- RSNA Show Report – Topical Report – January 2022

- AI in Medical Imaging World Market Analysis 2022 – Core Report – July 2022

- Competitor Ecosystem – Topical Report – October 2022

- RSNA 2022 Show Report (NEW – complimentary) – December 2022

- Vendor Sentiment Index (VSI) – Quarterly

To find out more, please email the report author Sanjay Parekh at sanjay.parekh@signifyresearch.net.