In the wake of the COVID-19 pandemic markets across healthcare have changed dramatically. In particular, the general radiography and fluoroscopy market has experienced a significant shift, with chest x-ray examinations identified as a key tool used to diagnose and track the progression of late stage COVID-19.

The need for access to X-ray imaging within intensive care departments has skyrocketed, creating unprecedented demand for mobile imaging systems, which are easy to clean and transport between wards. For example, OEM manufacturer Micro-X published an increase in revenue of 375% compared to Q12019, with many other leading vendors citing substantial increases in orders.

In contrast, sales of fluoroscopy and fixed X-ray radiography rooms have dropped, as budgets are sequestered to focus on pandemic response. Site access restrictions have prevented or delayed pre-scheduled installations.

Such market volatility has created many challenges for the X-ray manufacturing industry and whilst predicting the coming months and years is very difficult, many are still asking: what happens next?

A Sharp Return to Normality

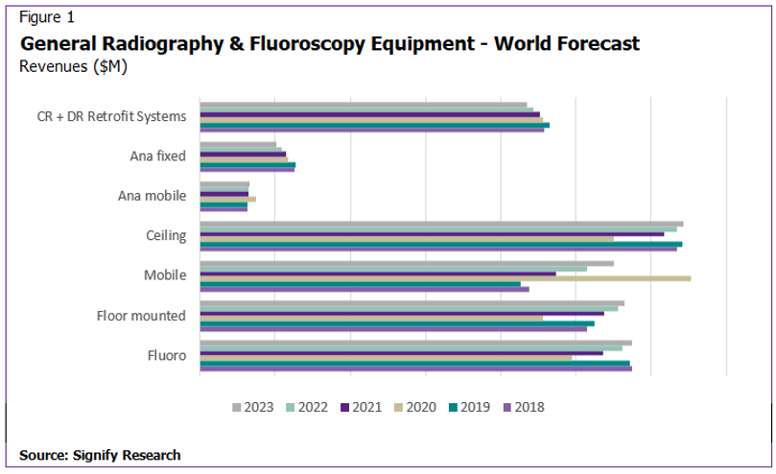

At Signify Research we have taken the view that the market will experience a sharp “V” shaped recovery in most regions, beginning in the second half of 2020. As lockdown measures are lifted and healthcare systems re-adjust, we expect pent-up demand for fixed radiography and fluoroscopy systems to be quickly realised. Previously scheduled orders for 2020 may push into 2021 as order backlogs will take time to fulfil. As outlined in Figure 1, most markets segments (excluding mobile and analogue) should return to pre-pandemic performance by 2022.

We have come to this conclusion for the following reasons:

1) Changes in demand for imaging procedures is temporary, and likely to surge post-COVID

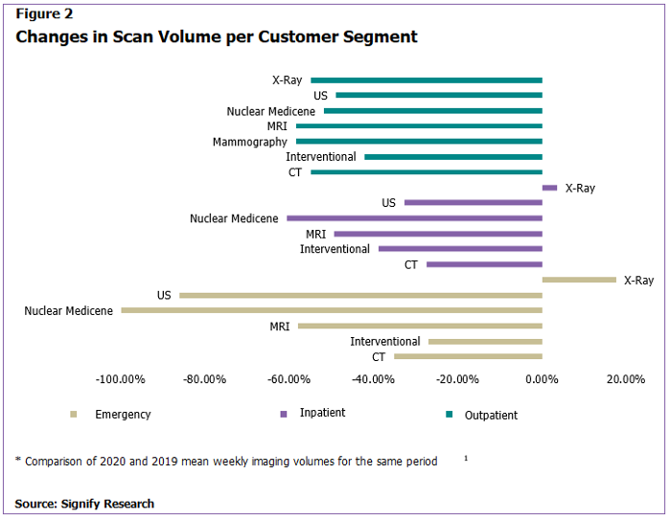

Changes to market conditions in Q1 2020 were rapid as the COVID-19 pandemic escalated, creating a shock to healthcare systems. In their reaction, healthcare providers entered “crisis-mode” and channelled resources towards pandemic-responses, sequestering budgets for critical care equipment. Previously scheduled orders deemed non-essential to this pandemic response were also delayed, with movement restrictions preventing on-site implementation activity. Elective procedures and normal operations in many clinical departments were also put on hold, leading to imaging volumes for non-critical exams experiencing massive drops. Initial evidence shows some modalities were affected more than others, see Figure 2.[1]

An April 2020 IMV survey in Europe showed more than 50% of healthcare provider respondents expected these volumes to return to normal in 2-3 months, whereas almost 25% expect this to take more than 4 months.

As the effect of the virus lessens and restrictions are lifted in 2H 2020, many radiologists are expecting a “reservoir” of scheduled exams to spike demand and creating further challenges for healthcare providers to address. The knock-on effect of high-volume use will be increased wear and tear on existing X-ray systems and a growing focus on efficiency and patient throughput. For this reason, healthcare providers are unlikely to cancel or postpone the installation of previously scheduled radiography and fluoroscopy system replacements and instead are more likely to bring forward renewals in order to increase efficiency. As logistical channels reopen, we predict a clear upturn, continuing into 2021 and 2022.

2) Order books remain healthy

Recent financial guidance from healthcare technology vendors have made it very clear a drastic market decline is not expected mid-term, with orders merely delayed rather than cancelled. This is something echoed across all healthcare markets to some extent from our analysis of recent financial investor calls, with vendors reporting healthy order books. For example:

Bernd Montag speaking on behalf of all imaging equipment for Siemens Healthineers described in the latest Q1 earnings call:

“In equipment, we believe there will be pent-up demand as the crisis does not change the underlying health care drivers.”

“So, when we – and when it comes to installations, we have a very healthy order book. And this is just a timing topic when hospitals get back to taking deliveries.”

Abhijit Bhattacharya speaking on behalf of Philips Healthcare stated:

‘It is important to note that we have not seen any cancellation of orders due to the COVID-19 outbreak’.

3) Radiography and Fluoroscopy will likely be least affected amongst potential imaging budget cuts, though emerging markets have a more risky outlook

In addition to this, mid-term healthcare budgets are less likely to be slashed as providers benefit from the range of stimulus packages designed to support them in this difficult time. The US, China, Japan, and Europe, which together account for most of the market, have all announced multi-billions in preparation for this, although it is unclear how effective these will be at this early stage.

General Radiography equipment is generally priced much cheaper than CT or MRI modalities. In some regions, asking prices are as low as $35,000 for a fixed system whereas CT and MRI modalities typically are sold for >$500,000. In addition to being a lower-cost purchase, general radiography equipment is also still some of the most frequently used in the hospital, with a recent IMV survey estimating a total of 152.8 million exams performed in the US on general X-ray equipment in 2018, compared to 114.9m in CT, MRI, PET and NM combined. This positions the market well in comparison to larger modalities should healthcare providers seek to implement budget cuts.

Emerging markets are however going to be hit harder, especially as markets such as Brazil and Mexico continue to deal with the rising impact of COVID-19 with limited resources and no obvious plan to counter the pandemic. General radiography market growth in some emerging regions is therefore expected to be dampened throughout the forecast; emerging markets account for around 26.5% of the global market, with Latin America, Russia and India expected to be most impacted.

Will a second peak affect the market?

A further unknown on the horizon for most healthcare providers and vendors is the possibility of a ‘second peak’ of cases. How much of an impact would a second peak have on the market?

In our opinion, there would be only a limited impact for general radiography and fluoroscopy X-ray. System demand for mobile imaging has already been addressed through emergency tenders. Vendors are also prepared for the pandemic to roll-on throughout 2020; GE Healthcare in their latest earnings call exemplified this reporting:

“…. we’re ramping production of critical medical equipment used to diagnose and treat COVID-19 patients, including respiratory, CT, monitoring solutions, X-ray, anaesthesia, and point of care ultrasound product lines.”

Markets are therefore only likely to be affected in the case of reverting to more stringent lockdowns, limiting access to hospital sites for installation of equipment, further delaying revenue. However, assuming imaging volumes will return to pre-pandemic levels in the interim, and reserves of critical care equipment will have been met, the impact of a second peak in most markets should be less pronounced than the first wave.

Where will change be most noticeable post COVID-19?

Radiography equipment can be found in acute hospitals, outpatient imaging centres and urgent care clinics. The balance of where radiography is performed is perhaps the most likely to change. Outpatient imaging centres broadly experienced the steepest decline across all imaging modalities following virus presence. This is shown in Figure 2. We also would expect patients may modify their behaviour to avoid exposing patients to imaging in hospitals. For this reason, outpatient X-ray imaging could become more common in the post-pandemic future.

In the US, outpatient imaging centres typically operate on tight budgets; the recent loss of revenue from decreased demand could lead towards more interest in value-priced solutions and retrofit equipment to manage capital outlay. A general trend towards floor-mounted systems, which are priced more cost-effectively than ceiling mounted systems could also be accelerated. With increased patient-demand, our upside scenario would also see substantial investment in replacing aging radiography equipment in the outpatient setting for systems supporting higher patient throughput.

Conclusion

Although market predictions currently come with a higher than usual sense of uncertainty in the current climate, the mid-term outlook for general radiography and fluoroscopy market is still promising. General radiography equipment one of the most used imaging modalities worldwide; with easing of pandemic measures expected over the next few months we are interpreting a broad market recovery in the next 2 years. However, with some leading emerging growth markets struggling to contain the pandemic and the threat of a “second wave” a possibility, several risks to market recovery still exist.

[1] Impact of the Coronavirus Disease 2019 (COVID-19) Q1 Pandemic on Imaging Case Volumes Q2 Jason J. Q12 Neidich, MD, MBAa, b