Since November 30th lifescience forums & AI enthusiasts have been abuzz with the news of DeepMind’s progress in protein structure prediction. But when will this improvement translate into real-world benefits for the drug development market?

“Proteins are the building blocks of life” – a concept that every biologist understands. Manipulating a protein’s function is often the basis of treatment for many diseases. Understanding a protein’s structure, and how it influences the cell, therefore makes up an important part of the drug development pathway. A quick method of accurately deducing a protein’s structure, however, has proved elusive for scientists, who currently spend years in the lab trying to narrow down potential formations. CASP (Critical Assessment of Structural Prediction) competition, a worldwide community experiment, to solve this problem, was conceived in 1994. This biennial challenge for computational biologists is used to help benchmark methods to predict the structure of proteins from just an amino acid sequence.

The competition made headlines in 2018, when Google’s Deepmind joined with its AlphaFold program, which significantly outstripped previous attempts. Two years on and its latest results, courtesy of ‘AlphaFold 2’, have proven even more exciting: the program managed to determine the shape of around two-thirds of the proteins with accuracy comparable to laboratory experiments. Some experts are now postulating that the team may be able to solve problems which previously took years, in a matter of days, with a transformative effect in the way diseases are treated.

But is this excitement premature? Following an extensive deep-dive into the AI in Drug Development market, we believe questions still remain as to whether DeepMind will be able to make a significant impact in the market any time soon.

Not Yet in the Market

The biggest hurdle to DeepMind’s program providing real-world impact so far is its accessibility.

The company’s software is not currently available for mainstream use, with little detail as to its eventual deployment and route to market. Whether the company chooses to enter the market as a commercial product, or release its algorithm for open-source use, there can be no dispute that little progress can be derived from a solution only in use on a limited number of projects per year.

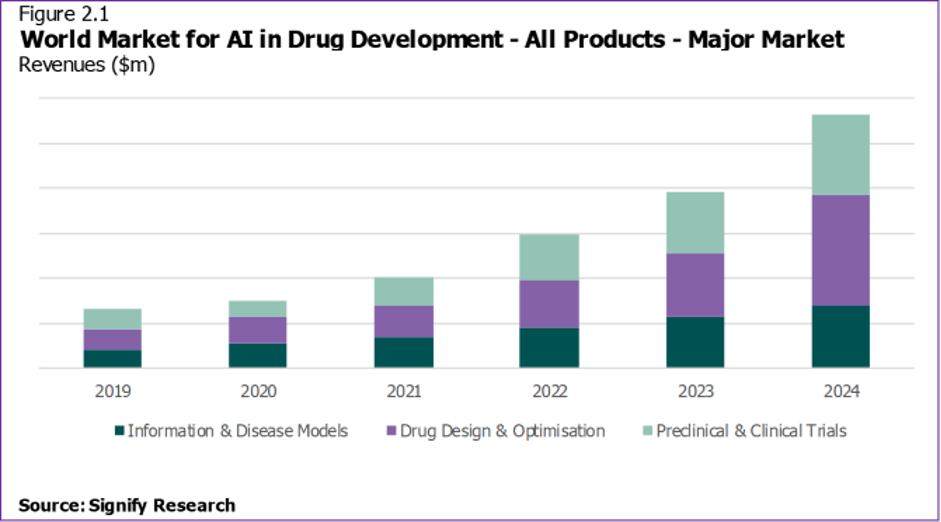

Meanwhile, many other vendors providing their own AI solutions have entered the market and begun competing for partnerships and subscription services. In our most recent study on the global market for AI in Drug Development & Clinical Trials, Signify Research has sized the 2020 global market at $804.6m and forecast growth of 34.26% CAGR from 2019-2024.

DeepMind has been quoted as “exploring how best to provide broader access to the system in a scalable way” with an announcement set for January 2021. Given the already competitive market and increasing strength of partnerships between major pharma, clinical trials and healthcare providers, entry will not be simple. Market entry, should it occur, will likely take another few years to achieve even a relatively modest share.

Has DeepMind’s late entry therefore hampered its chance of adoption? Perhaps, but there are other challenges to overcome too.

Not A Perfect Solution

Whilst AlphaFold 2’s results displayed significant improvement over DeepMind’s 2018 entry, the published outcomes were noticeably imperfect, with the program falling behind the experimental benchmark in a few cases. Indeed, a post-announcement discussion had DeepMind’s team acknowledging improvements were needed. In addition to its work on singular proteins, the team also noted an intent to work on complexes of multiple proteins, which are not evaluated as a part of CASP’s parameters.

There is also the relevant question of whether AlphaFold 2 will perform as admirably in real life as it does within CASP’s defined parameters. Scientists have noted limitations in the publicly available dataset AlphaFold 2 was trained on, so it is still largely unclear how useful the program will be in real-world settings. Certainly, these results do not allow structural biologists to hang up their lab coats just yet. For this reason, we expect that the ‘product’ will remain in development a while longer, and whilst DeepMind’s algorithm could be made more freely available and released to the public, a final commercial ‘product’ is unlikely to be announced anytime soon.

One Algorithm for One Point in the Development Timeline

The drug development timeline is a long and enduring process, often taking more than a decade from inception/design to market approval, and there are many hurdles to be overcome before success can be pleaded.

It is this characteristic of the market that has prompted the development of so many AI vendors, with over 250+ counted to date, tackling a plethora of problems along the timeline. In our 2020 market report, we have characterised these companies based on their placement within this timeline:

- Information Engines & Disease Modelsinform general drug discovery and can be used by the wider scientific community at the earliest stages of development.

- Drug Design & Optimisationvendors produce algorithms design to improve the drug design process and develop a candidate from inception through to preclinical testing.

- Preclinical and Clinical Trialsvendors work to improve, attenuate and speed up the clinical trials process therefore relieving sponsors of some of the substantial costs involved.

Whilst DeepMind’s program would currently fall into the first category, we are increasingly seeing vendors move towards novel drug design to lay claim to the more lucrative royalties associated with new discoveries. Companies are also launching to target the most expensive stage of development – clinical trial testing. These vendors typically use AI to tackle problems which produce more immediate results for sponsors to see, such as increased enrolment and patient adherence.

AlphaFold only performs one action in the overall development pathway, protein structure prediction. Yet there are a host of other challenges that make drug development difficult and slow: predicting binding affinity, designing drugs, simulating drug mechanisms in silico or tackling the numerous problems surrounding clinical trials.

With pharmaceutical sponsors taking an interest in AI use across the whole development process, there is no ‘one-stop’ that will fix the problems associated with drug development. Instead, a combination of solutions will be employed over the next few years; most leading pharmaceutical vendors today have at least one major AI partner, as well as their own in-house native development. AlphaFold may play into this mix but is a long way from a complete solution.

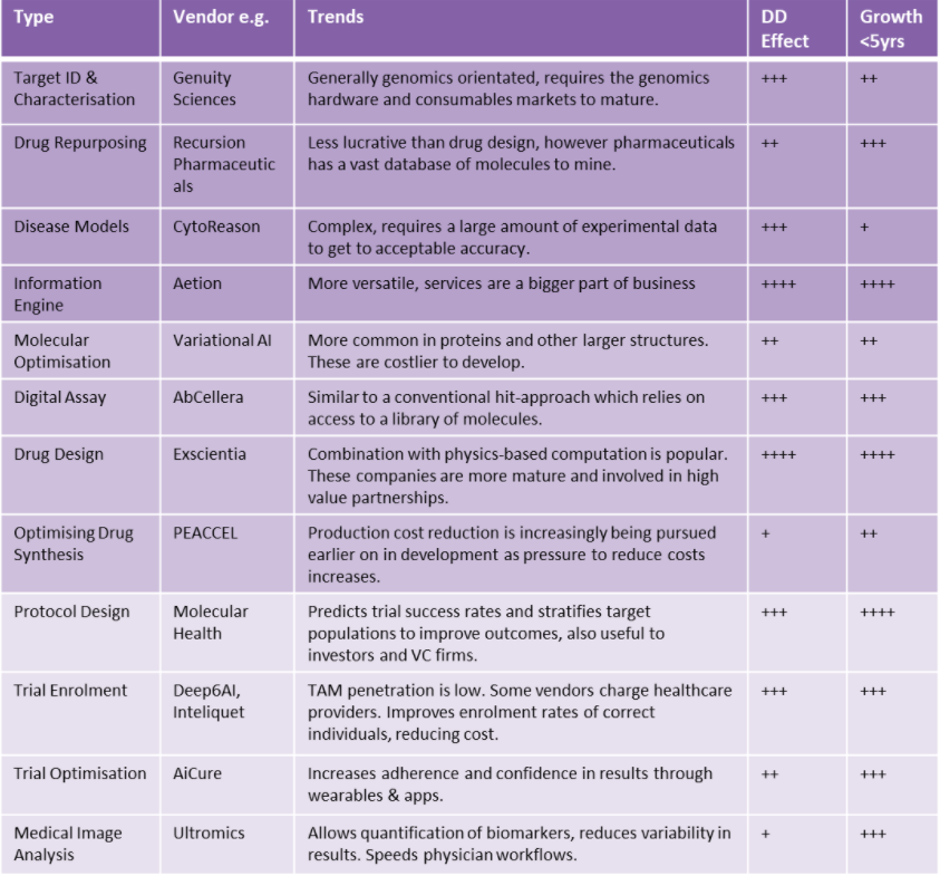

Exemplifying the fragmented nature of the market, we have listed some of the key types of products offered in the market today, alongside example vendors and the expected market effect and growth of each product category.

Whilst the solutions that are predicted to have the biggest impact on the market in the next few years are often those that enable quick cost savings on previously inefficient processes, revenue growth can also be seen in companies such as Atomwise, which provide services realising a return in revenue over a longer term. AlphaFold may have potential as a solution to save some development cost, but the actual savings for pharmaceutical companies in real-world scenarios remain to be proven. No doubt some will take this risk on good faith of the evidence so far, but others may choose to focus on other solutions that have more solid real-world grounding and evidence.

Conclusion

Following DeepMind’s intended announcement in January, we expect the company to focus on its internal development in the short term, meaning that for now, the impact of AlphaFold 2 on the market will remain limited.

Once the company does emerge, and depending on its entry strategy, the free marketing and low costs associated with the use and publication of its results through CASP do mean that its uptake and entry could be quicker than other solutions. However, as outlined above, AlphaFold 2 is entering a competitive and dynamic sector, with no guarantees it can transfer its capabilities to use in real-world drug discovery. Whilst this progress is certainly a promising step in the right direction and highlighted the potential of the technology, there is still much more work to be done. It is far from certain that DeepMind and Google will see out the difficult process of taking this development to commercial success based on today’s evidence.

Instead, it looks likelier that other companies already implementing their solutions into everyday use with pharmaceutical, CROs and healthcare providers will have a much bigger effect on market dynamics in the coming years.

About the Report

“AI in Drug Development & Clinical Trials 2020 World Market Report” provides a data-centric and global outlook on the current and projected uptake of Artificial Intelligence throughout the drug development timeline. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150