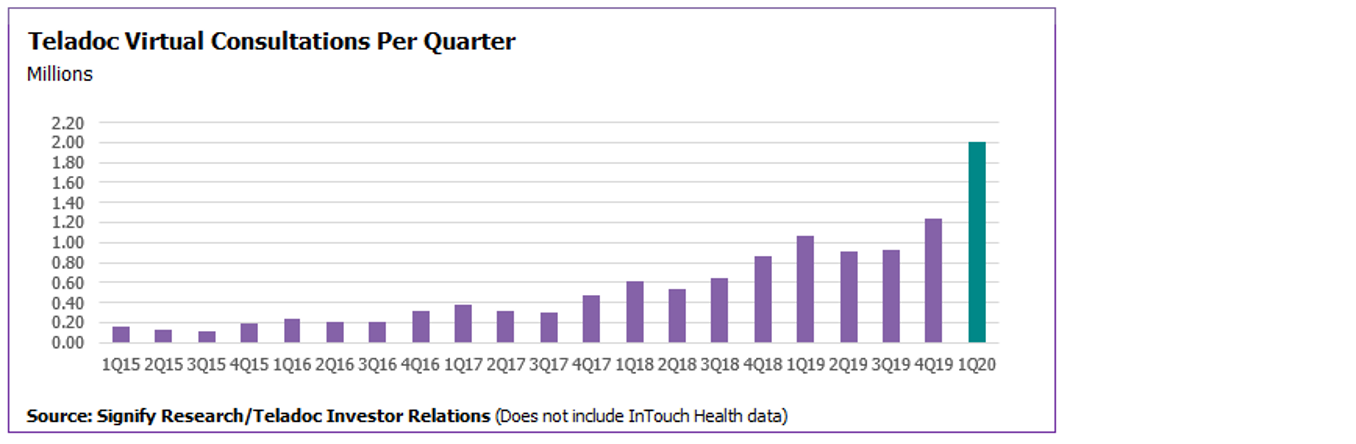

Last week saw Teladoc Health release its 1Q20 financial results giving the US telehealth industry a first glimpse of how COVID-19 is impacting the ambulatory virtual care market. Discussion around the crisis and its impact on telehealth has been rife since early March and the data published by Teladoc Health highlights that this was justified.

The company reported that the number of virtual care consults in the quarter had passed the 2 million mark, up approximately 60% from the 1.24M reported for 4Q19 and up nearly 90% on the 1.06M for the same period in 2019. Much of this growth had been seen over the period from the start to end of March, with average daily consultations doubling over the month. Teladoc’s forward-looking statements suggest it expects rapid growth to continue into the next quarter as the full impact of COVID runs for three months, with volumes then flattening in the second half of the year, maintaining the new highs but with growth rates falling back to those seen historically.

Other leading payer/employer-focused telehealth service providers in the US have also been reporting similar levels of success. For example, MDLive reported in early April it had seen volumes increase by 50% between the start of March 2020 and the week of 6th April 2020.

Although these service providers do have some provider customers, the bulk of consultations are driven by payer and employer customers, with consultations provided by Teladoc’s and MDLive’s own associated physicians (similar models are also true of AmWell and Doctor On Demand, for example). What this data does not tell us, is the extent to which virtual care has changed the types of consultations provided by traditional practices in the US.

On 17th March the Centers for Medicare & Medicaid Services (CMS) announced that effective of 6th March it was expanding the range of Medicare telehealth services that would be reimbursed on an emergency and temporary basis during the period of the COVID crisis. The change lifted many of the location-based restrictions that had been in place prior to the crisis and it also removed the need for an established relationship to be in place between provider and patient prior to a telehealth visit.

The announcement precipitated a flurry of developments from virtual care platform vendors targeting practices looking to ramp up their telehealth capabilities. It also saw at least one non-US platform vendor, Sweden’s KRY (branded LIVI in English speaking countries) launch its first products targeted at the US market. Based on initial data that Signify Research has obtained from a range of vendors that are supporting practices in terms of technology, the percentage increase seen by Teladoc in 1Q20 is likely to be dwarfed by the increase seen by practices supporting their own virtual care consultations using technology from ambulatory EHR vendors and specialist virtual care platform vendors (e.g. NextGen-owned OTTO Health).

A key question for the industry is whether this is the “new normal” or whether the market will see a return to pre-COVID trends once the peak of the crisis has passed. It is Signify Research’s view that the rapid growth will continue into the second quarter, as the full impact of the CMS changes and the crisis runs for a full quarter. As per the Teladoc guidance, we then expect volumes to plateaux to some extent in the second half of the year. As lock-down restrictions in the US are gradually lifted over the second half of the year, it is forecast that growth in virtual consultations will drop, falling to low single-digit levels in 2021; however, we do not expect volumes to drop to pre-crisis levels. New technology, new processes/workflows, a change in attitude by providers and a change in culture with consumers are all expected to help sustain these new higher rates of virtual consultations. A more detailed analysis of these trends is explored in Signify Research’s May 2020 global telehealth market report.

Mixed International Picture

The international picture is a little more mixed. There are certainly other countries like the US that have seen an explosion in virtual care consultations due to COVID. But the market conditions need to have been right.

In France, the combination of new reimbursement structures being put in place prior to the crisis in 2019, coupled with the impact of lockdown since early March has transformed the virtual care market.

Booking Management System (BMS) platform vendor Doctolib has been the main beneficiary of this transformation. On 22nd April it announced it had passed the threshold of 2.5M virtual consultations conducted by physicians in France using its platform since the start of the lockdown, putting it on par with the volumes seen by Teladoc. The company had only launched its video consultation service in January 2019, and achieved volumes estimated at under 100,000 during 2019. Data from Doctolib (which also facilitates in-person consultations via its BMS platform) suggests that the share of online consultations continued to increase rapidly during the period of lockdown. In March 12% of appointments made via its platform were virtual, increasing to 45% in April.

When it changed its reimbursement structure, the French government had originally expected 1.2M virtual care consultations in total across France in 2020; this number has already been eclipsed and could easily be a factor of four or five more by the end of the year. Doctolib has also expanded the platform to its German customers, where 10% of its German physician practice customers have now signed up to use the solution.

The combination of the new reimbursement structures, alongside the lockdown and the fact that Doctolib had already established itself as the go-to online platform for physical appointment bookings, meant that France was particularly well primed to adapt to virtual care and has been catapulted to a position of global leader in terms of primary care telehealth.

Conversely the UK paints a very different picture. Data released by NHS England showing appointment by type during March 2020 highlighted a significant month-on-month decline in online/video consultations, and below average YoY increase compared to the last six months.

The NHS data did highlight some data quality issues, suggesting the figure may be an under-call. However, the picture is still very different to that previously discussed in the US and France. The number of phone-based consultation, however, did increase significantly in the UK, more than doubling in March. Clearly the UK has focused more on replacing in-person visits with phone-visits instead of video/online visits during the initial phase of the crisis.

The trend seems very much at odds with developments in the UK prior to the crisis. The NHS had already been exploring the extent to which it would use telehealth service provider Babylon Health across a variety of UK NHS trusts and had also deployed virtual care solutions provided by Swedish-based KRY/LIVI (amongst others) in several physician practices across the country. Virtual care and the broader use of digital technology was also a core element of the NHS long-term plan published in January 2019. Additionally, the start of the crisis saw UK primary care EHR market leader EMIS offer virtual care modules for free to its 4,000 UK GP customers. The question therefore begs as to why this early data for the UK is not more in line with that seen in the US and France.

There are a few points to consider here:

- The UK was a little later than many other European countries, and parts of the US, to enter lockdown. Therefore, April and May numbers may be more representative in terms of capturing the COVID impact. Certainly, the experience of Doctolib in France backs this up.

- The focus in the UK in terms of its COVID response has been more towards phone-based consultations, an area the UK public is very familiar with via the NHS 111 service which has been in place since 2014 (and its predecessor since 2007).

- Doctolib, Teladoc Health, American Well and MDLive are all household names/brands in their respective countries, meaning that they were already the “go-to” platforms for many consumers managing their interactions with health services. No similar platform exists yet in the UK. Even Babylon Health (and its NHS brand GP At Hand), which is well-recognised in health IT circles, is largely unknown to the wider UK population.

- The “NHS App” is, however, relatively well known and well used in the UK. That said virtual consultations were not offered on the app until very recently, when eConsult online triage form-based tools were added at the end of April 2020. However, not all practices use eConsult and the solution does not include a video consultation tool. Additional virtual consultation tools are expected to be added to the app throughout May and June.

The last point is particularly salient, and as the roll out of virtual care via the NHS app develops during the next two months, it is forecast that an upturn in volumes will rapidly follow, although the culture of phone-based services is projected to keep demand below those levels seen in France and the US.

Data published by Medicare Australia on 7th May (including data up to 31st March) indicates that an explosion in the use of telehealth is set to occur in Australia. Until 29th March there were still tight geographic restrictions on the use of Medicare-subsidised telehealth services in Australia. These restrictions were lifted on this date, and at the same time Medicare published over 130 new telehealth claim codes as part of its COVID-19 strategy. In the two days of March that the new codes were in effect there were more than 60,000 claims according to Medicare official statistics. Prior to this Medicare had been subsidising approximately 20,000 virtual consultations per month. Extrapolating 60,000 over two days to a full month would suggest a figure approaching 900,000 virtual consultations subsidised in April, more than 3,500% up on February. Signify Research will monitor this as new data is published.

China Has Potential to Give Insight to Post-Lockdown Trends

China is several months ahead of Europe and the US in terms of the COVID impact. Lockdown restrictions were relaxed during March and April, with the impact of lockdown more acute during January and February.

In terms of primary virtual care, China saw similar trends to those described earlier in the US and France in March and April, but during the first two months of 2020. A summary of trends with some of the leading service/platform providers is provided below:

- WeDoctor (owned by Tencent) – launched a free version of its platform on 23rd January. By the end of February it had handled more than 1.5 million enquiries through the platform (note some were phone-based).

- AliHealth (owned by Alibaba)- launched a free version of its virtual care platform and support through the Alipay platform in January. Traffic increased to 3,000 consultations per hour during the peak in February.

- Wenyisheng/Ask A Doctor (owned by Baidu) – launched a free version of its virtual care platform in January. The company claims the volumes of consultations had increased by a factor of 50 in February 2020 compared to those seen 12 months before.

- Ping An Good Doctor (owned by Ping An Insurance) – recorded a factor of ten increase in the number of new daily users of its virtual care platform during the period 22nd January to 6th February compared to the first 21 days of January.

- JD Health (owned by JD.com) – launched a free version of its platform in January. It also launched several tools to support triage services for local hospitals based on the likelihood of COVID symptoms. By the end of January, it had seen online consultations relating to respiratory illness jump by a factor of nine compared to pre-crisis levels.

Over the next 3-4 weeks, many of these companies will be providing their 1Q20 results. These will capture the trends described above and will also capture how these subsequently developed in March as restrictions were gradually lifted. Signify will provide additional insight at this time and discuss to what extent they will be an indicator as to how Western markets may develop in the short-term as restrictions are lifted elsewhere.

The Wrap

Without doubt COVID-19 has transformed the primary/ambulatory virtual care market. For most countries this has resulted in a significant increase in virtual consultations in recent months. Some countries were particularly well primed in terms of market conditions (e.g. France, US) for exceptional growth, whereas in others the impact is forecast to take a little longer (e.g. the UK).

Growth is forecast to peak towards the end of 1H20 as new workflow processes that address COVID lockdown restrictions are standardized and the initial peak of new infections passes. Whilst the new processes are in some ways temporary, the medium-term impact is forecast to be a huge increase in the number of virtual consultations over the next five years. After 2020, growth is forecast to drop to well below pre-COVID levels. However, Signify Research does not expect a major decline in virtual consultation volumes in 2021 and beyond. A “new normal” is forecast to follow that will help maintain the volumes seen during the COVID crisis. Until a vaccine is developed, primary care providers will still demand solutions that keep high-risk patients out of primary care health facilities where possible, and virtual care technology will be a core element of this strategy.

Related Reports from Signify Research

Signify Research will be publishing its 2020 telehealth market report in May 2020. The report will provide a detailed global assessment of the trends described above. The above only discusses the impact of COVID-19 on the primary care virtual consultation market. Telehealth is much more than this and the report will examine a range of other telehealth markets such as surgical/medical support in acute settings, provider-to-provider telehealth, tele-ICU and remote patient monitoring. Each of these has also been impacted by COVID and this is fully explored in the report.

To find out more:

E: Alex.Green@signifyresearch.net

T: +44 (0) 1234 986 104