By Arun Gill, Senior Market Analyst at Signify Research Ltd.

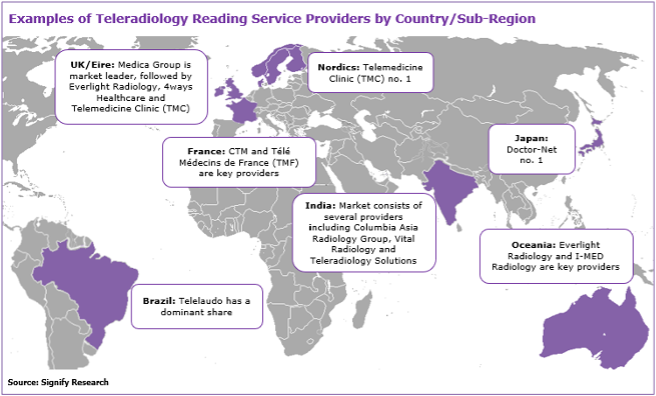

The global teleradiology market is served by a broad range of vendors, including international players with operations in multiple countries, and local vendors significant in their domestic country/sub-region, many producing 100,000+ teleradiology readings of diagnostic images annually.

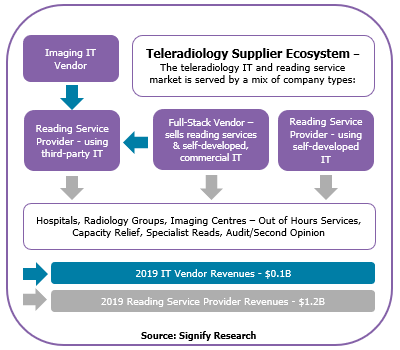

The teleradiology market consists of two key components – Teleradiology Reading Services and Teleradiology IT – the mix of company types falling into these components is illustrated below:

Each of the different company types are explored below, with analysis of example vendors falling into each category:

-

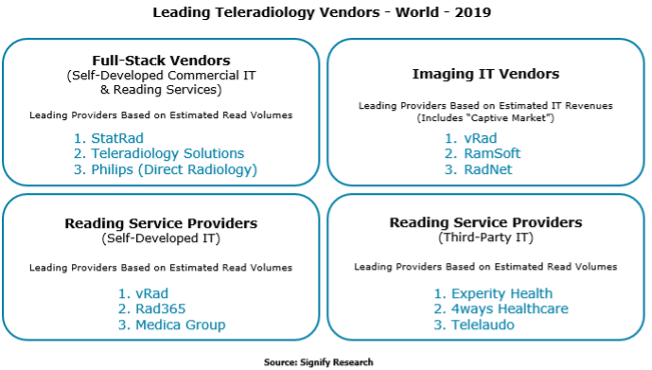

Full-Stack (Self-Developed Commercial IT and Reading Services)

Includes teleradiology reading service providers that have developed their own IT, which they use to support their own services and make commercially available for third parties to purchase. Example vendors include:

Teleradiology Solutions (Telerad Tech)

Teleradiology Solutions (TRS) is an Indian-based independent provider of teleradiology services, which relies on its own technology platform arm, (Telerad Tech) and third-party IT to offer its RIS/PACS cloud-based workflow solution (RADSpa). The vendor is the largest outsourcer of teleradiology services in India. Globally, it provides an estimated 1m+ reads annually to countries including the US, Nigeria, Tanzania, Uganda and Singapore.RadNet

US-based RadNet entered the teleradiology market 10 years ago when it acquired eRAD (IT solution) and Imaging On Call (reading services), with the latter generating approximately two-thirds of RadNet’s annual teleradiology revenues. In terms of its IT, its target customers are teleradiology service providers, reading groups, outpatient imaging centres and hospitals. The vendor was estimated to be a top-8 provider of US teleradiology reading service volumes in 2019. However, revenue generated from its “Imaging on Call and Software” reportable segment has been falling in recent years, and with teleradiology accounting for <2% of RadNet’s overall revenues, the ongoing decline in its teleradiology business could potentially threaten the company’s long-term commitment to this market.Philips (Direct Radiology)

Philips acquired Direct Radiology’s teleradiology platform and reading services business in March 2019. Here Philips kept the reading service element of Direct Radiology as a separate entity but integrated the Direct Radiology IT into the broader Philips portfolio of imaging IT, allowing it to develop a strong competitive edge in the teleradiology IT market. Direct Radiology was estimated to be a top-6 provider of US teleradiology reading service volumes in 2019. In August 2019, Philips strengthened its platform offering with the acquisition of Carestream Health’s Healthcare Information Systems (HCIS) business. Carestream was estimated to represent the fourth-highest share of global teleradiology IT vendor revenues in 2019. -

Reading Service Provider (Self-Developed IT)

Includes teleradiology reading service providers that have developed their own IT, which they use to support their own reading services, although the IT is not made commercially available at scale to third parties. Companies that fall into this category include:

vRad

Following several years of organic growth, US-based vRad was acquired in 2015 by the publicly traded healthcare services / physician practice management provider MEDNAX. In 2018, Mednax reported 11.5m radiology studies and revenue of $3.6bn, of which vRad accounted for 58% (6.7m) and 6% ($232m) of the overall MEDNAX group volume and revenue, respectively. In 2019 vRad (via its network of 500+ radiologist reporters) performed a similar level of teleradiology reads, representing not just the largest teleradiology provider in the US market, but also globally. As we discussed in our June 2020 insight, Mednax made the decision to sell its radiology and teleradiology business. In December 2020, Radiology Partners finalised its $885m acquisition of the Mednax imaging business line, bringing together two of the leaders in US radiology with a combined 2,400 radiologists across all 50 states, reading c. 35m exams annually. The move will allow Radiology Partners to begin offering teleradiology out-of-hours reads to its smaller practices.

Doctor-Net

Doctor-NET is the leading provider of teleradiology reading services in Japan, and a top 10 player globally, with an offering that includes diagnostic image reading, on-site (Doctor PACS) and cloud-based (Virtual-RAD) IT software, and AI interpretation services.

Telemedicine Clinic (Unilabs)

Spanish-based Telemedicine Clinic (TMC) is a leading European provider of sub-speciality teleradiology reading services. The vendor is a leader in the Nordics where it serves the Swedish and Danish market, and a top four player in the UK, where it is an approved supplier to the UK’s NHS Trusts. TMC also has Australian facilities in Sydney and Noosa for providing its “On-call” service (out-of-hour and emergency teleradiology reads) for European hospitals, whereas the “Elective” teleradiology reading service is provided for the UK and Nordics. In November 2017, the vendor was acquired by Unilabs, a European provider of lab medicine, radiology, pathology and genetics, operating lab and diagnostic imaging facilities in 15 countries across Europe and the Middle East. The combined Unilabs and TMC network consists of >550 radiologist reporters, interpreting c.4m examinations annually for its European clients.

-

Reading Service Provider (Third-Party IT)

Similar to the above group in that it also provides reading services, although the IT platform is provided by third-party providers. Examples include:

Columbia Asia Radiology Group

Indian-based Columbia Asia Radiology Group is one of the largest hospital groups in Asia, with small and medium sized hospitals across Malaysia, India, Indonesia and Vietnam. It is a leading provider of teleradiology reading services domestically and also has international presence, including in the US, EMEA and South-East Asia.I-MED Radiology Network

I-MED is Australia’s largest radiology network and third largest imaging provider globally, with clinics in every state/territory. In 2018 European private equity firm Permira acquired the group for AUD1.25 billion (USD0.93 billion) and has since supported I-MED’s acquisitions of local radiology groups. Teleradiology is a relatively small part of the overall business; I-MED performs almost 5m patient procedures annually, although emergency and after-hours teleradiology reporting from its ‘I-TeleRAD’ group represents around 10% of its annual volumes.The graphic below includes examples of reading service providers by country and shows that many countries are dominated by local vendors.

-

IT Only

Includes IT vendors that sell either their standard imaging IT products or solutions tailored for teleradiology, to teleradiology reading service providers. These include traditional imaging IT vendors such as Intelerad, Fujifilm, GE, IBM and OnePACS, and teleradiology IT specialists such as RamSoft and Meddiff Technologies.

Intelerad

Intelerad is a Canadian-based provider of teleradiology PACS, enterprise and workflow solutions. It features most prominently as a supplier of third-party IT for several teleradiology vendors, including I-MED Radiology Network (I-TeleRAD), Integral Diagnostics, Global Diagnostics and Everlight Radiology.Meddiff Technologies

With over 800 clients and more than 1,500 installations, Meddiff is the leading teleradiology platform provider in India. Its clients include India’s leading medical institutions in both the public and private sector, such as Apollo, Fortis, Manipal, HCG, and overseas, such as Columbia Asia (Malaysia, Indonesia, Vietnam) and European Scanning Centre (UK).

Fragmented Teleradiology IT Competitive Environment

Whilst the teleradiology reading services market has a clear market leader in vRad, the teleradiology IT market is not dominated by any vendors, with contracts often relatively small in value and fragmented. In recent years, there has been an increasing trend for vendors to have a mix of self-developed and off-the-shelf (third-party) IT solutions for teleradiology. Everlight Radiology, Medica Group and USARAD are examples of vendors that use a commercial PACS solution from a traditional imaging IT vendor, in conjunction with a self-developed workflow solution.

A substantial proportion of the teleradiology market is served in-house; our analysis of the “Top 20” teleradiology reading service providers (based on annual volumes) shows that around 40% of vendors were using self-developed IT, almost 20% were using a combination of self-developed IT and third-party IT, and the remaining 40% relied solely on third-party IT.

However, the “captive” IT market (i.e. the effective value of that IT business had it been provided on a commercial basis by companies in the Reading Service Provider – Self Developed IT category) is anticipated to gradually decline moving forwards, as increasingly off-the-shelf, third-party IT solutions are purchased. Overhead costs associated with the continuous development of IT solutions could in fact become a burden for the reading services providers developing their own IT, namely vendors included in the “Full-stack” and “Reading Service Provider – Self Developed IT” company types, particularly for the latter; whilst this group of vendors may gain a competitive advantage by choosing not to make the IT commercially available at scale to competitors, the drawback is that their IT does not generate additional revenue.

Therefore, it is anticipated that over the forecast period of our Teleradiology – World – 2021 report, there will be a gradual trend towards IT vendors selling their standard imaging IT products or solutions tailored for teleradiology, to teleradiology reading service providers.

Teleradiology Vendors Will Continue to Partner with AI Specialists

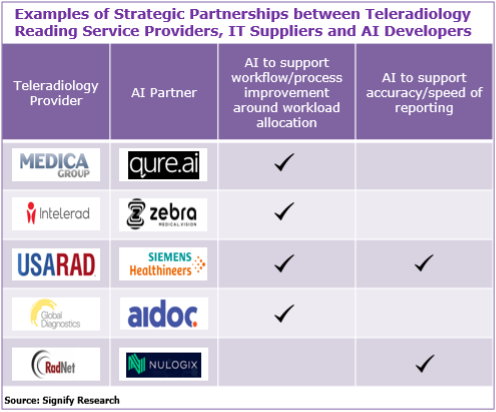

As discussed in our previous insight, technology advances relating to AI will have an increasingly positive impact on the success of teleradiology reading service providers. There is a growing trend for strategic partnerships between reading service providers, IT suppliers and AI algorithm developers, with the aim of improving workflow and decision support processes, and the accuracy/speed of radiologist reports.

There are very few examples of teleradiology vendors developing AI in-house due to the associated development costs highlighted above, and so it is anticipated that vendors will increasingly partner with AI specialists. The table below highlights some examples of these partnerships:

COVID-19 Impact on Teleradiology Vendors

The rapid decline in global elective diagnostic imaging procedures during 2020 due to COVID-19, and subsequent second and third wave of rising cases in several countries throughout H2 2020, resulted in a significant drop off in non-urgent imaging volumes. Whilst teleradiology is used to service out-of-hours reading services and has been sheltered to some extent from this impact, greater hospital/imaging centre capacity caused by lower procedure volumes resulted in teleradiology reading service providers experiencing a significant drop in the number of reading volumes. As highlighted in our previous insight, the decline of vRad’s imaging volumes by c. 55% in April 2020 is just one example of dramatic declines reported by several vendors.

However, the outlook for the teleradiology market and its vendors remains positive. Unprecedented challenges that healthcare providers (radiology groups, imaging centres, hospitals, etc.) have faced over the past year have contributed to them seeking improvements, particularly in terms of radiologist utilisation and operational efficiency. Additionally, the December 2020 Centers for Medicare and Medicaid Services (CMS) announcement to drastically cut diagnostic radiology reimbursement by 10% in 2021 will place further pressure on US healthcare providers to downsize their internal workforce and outsource outpatient imaging, with increased demand for teleradiology a likely outcome.

Outlook for World Teleradiology Market Competitive Environment

There has certainly been an accelerating trend of consolidation of outpatient radiology groups and teleradiology reading service providers, particularly in the US, and demonstrated with the M&A activity highlighted above involving companies such as Philips (Direct Radiology) and Radiology Partners (MEDNAX/vRad). Whilst future acquisitions are gradually expected to take place in this dynamic teleradiology environment, it is unlikely to significantly alter the high level of fragmentation amongst the global supplier base, dominated by local providers.

About the Report

April 2021 will see Signify Research publish its Teleradiology – World – 2021 market report. The report will examine the penetration that teleradiology has made into the overall number of diagnostic imaging procedures performed globally, including the impact of COVID-19, and, specifically, in 20 core countries and sub-regions. It presents our estimates and forecasts provided to 2025 for the market for teleradiology reading services (reading volumes, revenues and revenue per read), teleradiology IT and the competitive environment (from a reading service provider and IT vendor perspective) in each of the 20 countries and sub-regions mentioned above.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.