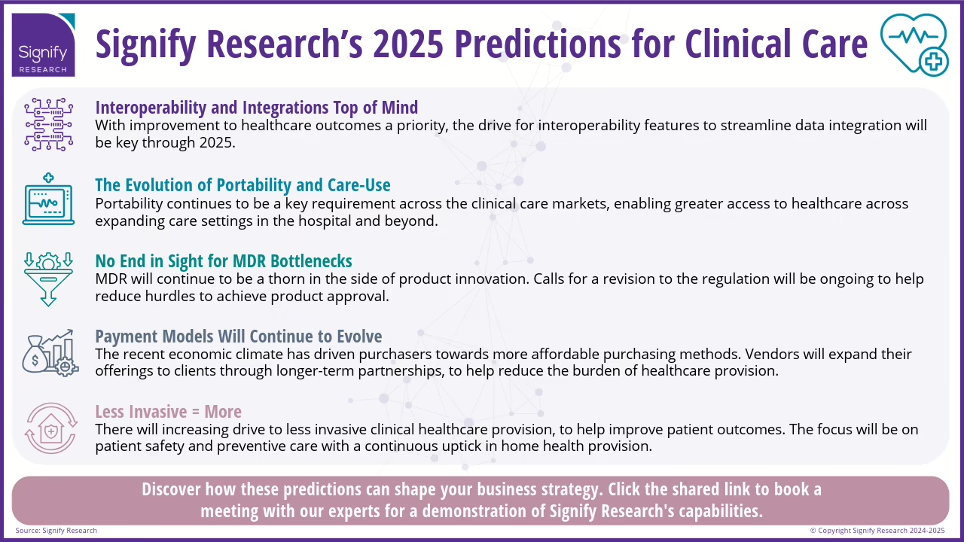

The Clinical Care market is continuing to see a rebalance in demand in the Post-COVID-19 era. The market’s peaks and troughs seem to be a thing of the past, with 2025 looking to see a reset in market dynamics for several products. That said, many segments are set to continue to see evolution as product demand has altered to the new way in providing patient care. This insight further discusses the top five trends Signify Research predicts for the Clinical Care market in 2025 presented in our latest infographic.

1 – Interoperability and Integrations Top of Mind

Patient data continues to be an important aspect in helping to improve patient outcomes; the capability of using real-time data to guide clinical decisions is a now a reality more so than ever. This hasn’t come without the issues faced in ensuring critical data points can be transferred with the patient along their care pathway. Interoperability features remain attractive to healthcare providers aiming to streamline workflows, reduce errors, and meet regulatory requirements. This will boost further adoption of integrated devices, especially with hospital infrastructure investment increasing in all regions.

The Global move toward Value-Based Care (VBC) has further driven the need for better data aggregation and health information exchange. While the service-oriented device connectivity (SDC) standard remains the north star for medical device and data integration, it is not expected to be approved or rolled out during 2025. Consequently, point-to-point integrations, driven by provider demands for ‘the single pane of glass’, will continue in earnest. Signify Research expects to see integrations along the entire length of the patient acuity scale, from high-acuity diagnostics and treatment in the operating room, to chronic disease monitoring and management in the home. Further discussions are also expected to make the ‘Smart ICU’ a reality in the not-too-distant future, remaining a feature topic at several events throughout 2025.

2 – The Evolution of Portability and Care-Use

The Clinical Care market continues to evolve, with a definite movement toward preventative care. As healthcare systems are increasingly placed under strain, care models are shifting to ensure high-acuity care is reserved for the most critical of patients. The movement of patients into lower acuity settings and the home is altering the solutions that are in most demand. The highest featured solutions remain for high-acuity settings, whereas easy-to-use solutions are increasingly sought in lower acuity settings. This trend will drive the development of user-friendly, transportable devices that meet rigorous safety standards, creating new opportunities not only in step-down wards, but also in outpatient and home healthcare markets. The transition to home care is accelerating the demand for enhanced connectivity and remote patient monitoring, ensuring seamless care delivery and improved outcomes in these environments.

The ambulatory diagnostic cardiology market has already seen the development of 4-1 ECG monitoring devices, personal ECGs, combined BP/ECG home devices, and combined Stethoscope/ECGs. More partnerships between OEMs, AI-ECG companies, and contract manufacturing companies, will see medical-grade ECG embedded into evermore form factors. Advances in portable 12-lead resting ECGs, again supported by a strong pipeline of AI-ECG algorithms, will shake up the traditional ECG device market.

In anaesthesia, where machines are traditionally confined to surgical settings, compact sedation systems for outpatient and mobile care will gain traction, especially for use in minor surgeries and remote settings. Demand for portable ventilators will continue to rise, highlighted by the trend toward at-home care for chronic respiratory diseases and the increased awareness from COVID-19. Lightweight, wearable infusion pumps that allow patients to manage treatments like insulin delivery, or pain management at home will become more widely available.

3 – No End in Sight for MDR Bottlenecks

The MDR saga has continued, with many vendors still citing it as a pain point in market expansion to and within Europe. Such has been the challenge of implementing the EU’s ‘new’ (2017) Medical Device Regulation (MDR), in late 2024 the EU Parliament passed a resolution calling for ‘urgent’ revision of the MDR and accompanying In Vitro Diagnostics Regulation (IVDR). However, the text adopted does little to shift the practical regulatory burdens on vendors or call for an extension of the transition period. Bottlenecks are likely to continue, risking both the availability of medical devices within the EU and the continuing focus of EU-based Medtech start-ups on the US market.

The rise of vendors such as Mindray, and now Comen and Edan, who offer competitive products at equally competitive prices, could cause further disruption to the grip ‘traditional’ vendors hold on this market. All three gained MDR approvals for several of their flagship products early into the new process, while other leading vendors looked to streamline their own portfolios to reduce both the effort and risk in gaining approval. As we continue to see healthcare systems around the world battle with dwindling healthcare budgets, the option of cheaper devices with similar technologies becomes increasingly desirable. With many new Asian vendors also gaining MDR approval and moving toward the likelihood of gaining FDA approval, the competition is only likely to become more fierce.

4 – Payment Models Will Continue to Evolve

Larger health systems in the US have increasingly been entering into long-term service contracts with MedTech vendors for the supply of medical devices, ongoing technical support, and associated software updates. In many countries, particularly where the public sector dominates healthcare, budgeting and payment models will need to be adapted towards subscription-based, OpEx models and away from traditional annual or project-specific CapEx models.

Partnerships between vendors and providers will be critical in convincing more conservative healthcare systems of the long-term benefits (including potential cost savings) of these models. Signify Research expects to see further related announcements in 2025, from a broader range of vendors and geographies. While this shift will present particular challenges for predominantly government-funded, capex-based healthcare systems, new procurement frameworks will begin to address this, albeit at a slower pace.

The continuing roll-out of enterprise-level Patient Monitoring solutions, based on subscription-based payment models will be one of the key market trends likely to be seen in 2025. Declining margins in equipment sales, and lessening points of difference between traditional Patient Monitoring devices across vendors, are forcing vendors to offer additional value-added services to healthcare providers. These can vary from cyber security services to alarm management, clinical surveillance, and early warning systems.

5 – Less Invasive = More

Whilst healthcare resource shortages remain paramount globally, there is a growing demand for simple and non-invasive solutions in the healthcare industry. Reducing demand for postponed care beyond that which is necessary, will drive demand for solutions that reduce patient recovery time and also limit the possibility of adverse events. Non-invasive products that are easy to use, require minimal training, and improve clinical workflow and flexibility while ensuring patient safety will be highly sought after.

In 2025, non-invasive respiratory health innovations will expand significantly, driven by a post-pandemic focus on lung protection and patient demand for safer treatments. Advances in wearable monitoring and preventive therapies are making respiratory care safer, more accessible, and increasingly standard. Hemodynamic monitoring is another clinical care area seeing a shift toward minimally invasive technologies. This trend will continue in 2025 as advances in AI-based algorithms and emerging vendors continue to promote alternative business models based on leasing, subscriptions, and non-proprietary consumables.

Click these links to view our other predictions for:

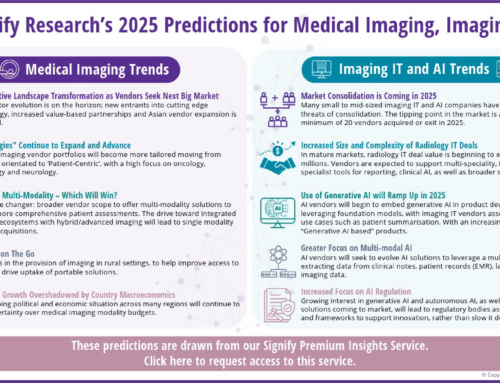

Digital Health | Diagnostics and Life Sciences | Imaging IT and AI | Medical Imaging

Questions? Ask an Analyst

Contact our experts should you have any questions or would like a demonstration of our research capabilities:

Kelly Patrick Research Director | Lead on Clinical Care Research Portfolio

Gareth Jones Senior Market Analyst | Patient Monitors, Diagnostic Cardiology

Sam Wilson Market Analyst | Ventilators, Fetal Monitors and Anaesthesia Devices

Alfie Edwards Market Analyst | Advanced Life Support Solutions

About Kelly Patrick

Kelly joined Signify Research in 2020 as a Principal Analyst. She has over 15 years’ experience covering a range of healthcare technology research at IHS Markit/Omdia. Kelly’s core focus has been on the Clinical Care sector, including patient monitoring, diagnostic cardiology, respiratory care, and infusion and associated IT solutions. Kelly holds a BSc degree with honours in Pharmacology from the University of Leeds.

About Gareth Jones

Gareth joined Signify Research in 2021 as Senior Market Analyst in the Digital Health team, where he covered emerging markets including Remote Patient Monitoring (RPM) and Ambulatory Diagnostic Cardiology. In 2023, Gareth joined Signify’s Clinical Care team where, his coverage areas include Diagnostic Cardiology and Patient Monitors.

About Sam Wilson

Sam Wilson joined Signify Research in 2023 as a Market Analyst within the Clinical Care team. He brings experience working as an Economist for the Intellectual Property Office, creating strategy reviews and impact evaluations, used to aid government trade negotiations. Sam holds a first-class bachelor’s degree in economics from Loughborough University, where modules included topical issues such as healthcare.

About Alfie Edwards

Alfie joined Signify Research in September 2024 as a Market Analyst within the Clinical Care team. Having graduated with a BSc in Biochemistry from the University of Southampton, Alfie gained an interest in bioscience business and bioinformatics.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia devices, and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences, Healthcare IT and AI in Healthcare.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.