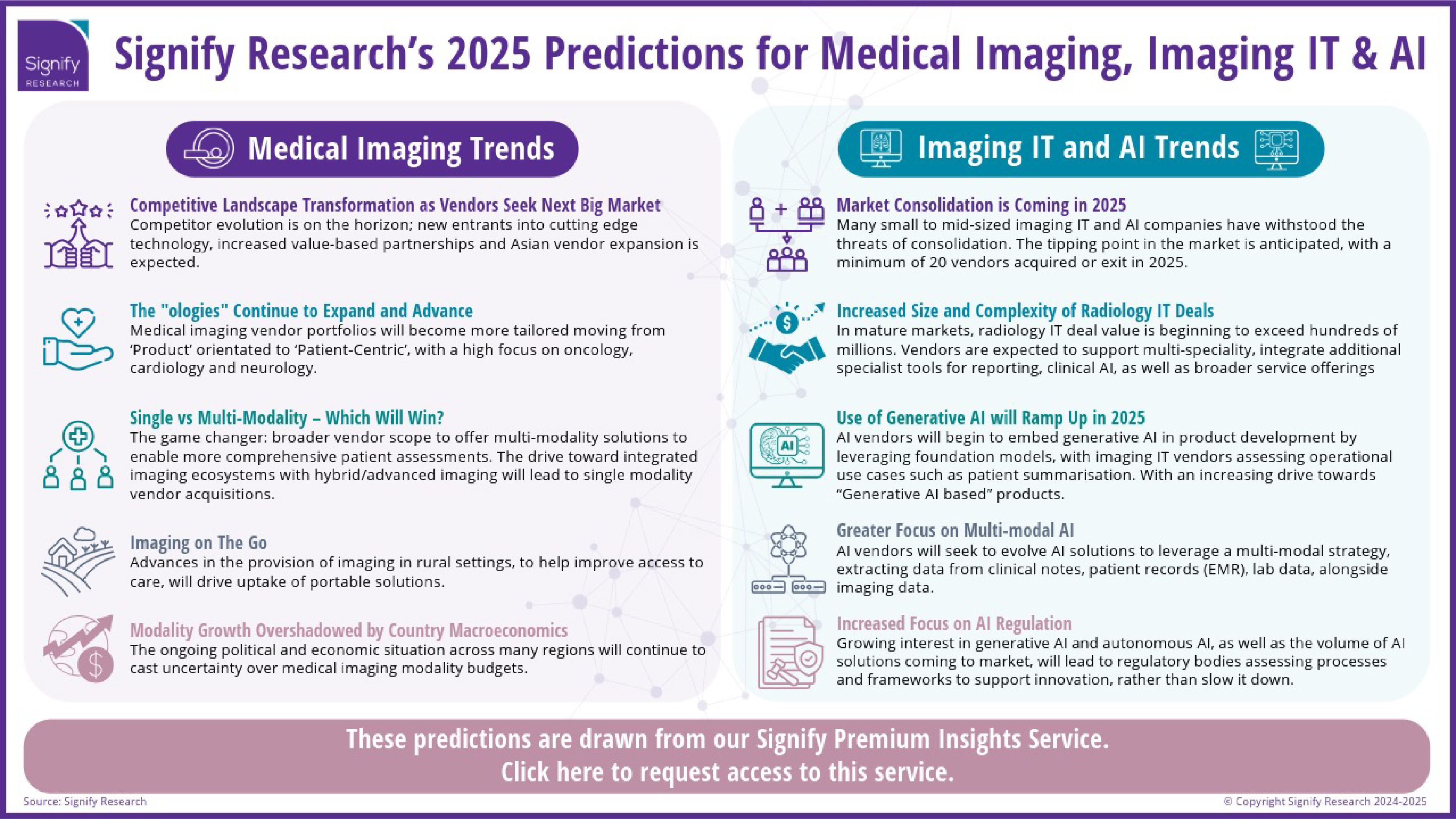

The medical imaging market is continuing to evolve through technological developments, changes in vendor offerings and increased demand for innovative solutions in light of workforce shortages. The need to improve workforce dynamics is further spearheading the acceptance of artificial intelligence in medical imaging. The importance of patient outcomes and subsequent reimbursement is evolving customer demand toward patient-centric imaging solutions. This insight discusses the top five trends Signify Research predicts for the Medical Imaging market in 2025 presented in our latest infographic.

Trend 1 – Competitive Landscape Transformation as Vendors Seek Next Big Market

2025 is set to see the launch of new emerging technology, such as photon-counting CT, digital SPECT, and whole-body MRI. These segments have been previously dominated by a select few vendors but are now expected to attract new entrants. This shift will foster a more robust supply chain, intensify competition, and drive dynamic changes in pricing.

Asian vendors will also continue to expand outside their domestic markets, gaining traction in new countries. Asian vendors are continuing to innovate not only on hardware, but also on their software offering. Positioning premium solutions at an attractive price point will also see these vendors gain further traction in price-sensitive markets, especially if they expand their offering to include extended warranties. Such developments will enable these vendors to expand their presence in the mid-range to high-end market segments.

2025 will also see a plethora of vendors forming more strategic partnerships focused on delivering value to customers. These ’Value-Based’ partnerships will provide value-added offerings including services, warranties, and maintenance to strengthen overall value. Vendors will also focus on providing ongoing training and support to help empower end users and address the workforce shortage.

Trend 2 – The “ologies” Continue to Expand and Advance

In 2025 and beyond, fields like oncology, cardiology, and neurology are poised to drive transformative advancements in medical imaging. As these specialties demand even more precise and personalised imaging, imaging technologies will evolve to provide earlier and more accurate disease detection, tailored to the unique challenges of each field. In neurology, increasing cases of conditions like stroke, aneurysms, and arteriovenous malformations (AVMs) are driving demand for effective, minimally invasive neurology treatments. The FDA’s full approval of Leqembi for Alzheimer’s is set to increase demand for Molecular Imaging and MRI imaging alike, particularly for monitoring of treatment and side effects.

Additionally, in cardiology, cardiac CTA has become the primary diagnostic and triage tool for chest pain, especially as improving guidelines continue to shape premium CT markets. In 2025, U.S. hospitals will see reimbursement rates for coronary CTA double, underscoring the growing recognition of its clinical utility.

Improving guidelines in lung cancer screening is also driving a surge in lung biopsies. Mobile C-arms are anticipated to be the primary imaging modality for guidance during these procedures. Additionally, mobile C-arms will also be increasingly used for ablation procedures.

Despite the importance of breast screening, many women face barriers that hinder their participation. Companies will increasingly offer patient-centric solutions, for example, in breast screening, including specialised options for women with dense breasts or high-risk factors. The provision of a comprehensive care pathway will be crucial to ensure optimal outcomes.

Trend 3 – Single vs Multi-Modality – Which Will Win?

Healthcare providers are increasingly adopting multi-modality imaging systems that integrate various imaging techniques (such as MRI, CT, and ultrasound) on a single platform. This approach allows for a more comprehensive assessment of patient health and reduces the need for multiple tests to ensure precision medicine. Additionally, the use of hybrid modalities like PET/MRI and SPECT/CT to provide comprehensive diagnostic information is gaining popularity. This is due to their ability to combine anatomical and metabolic information in one scan, enhancing diagnostic accuracy in complex conditions like cancer and cardiovascular disease. Uptake of multiple modality imaging will be further driven by the need to provide a comprehensive connected tool kit for doctors. This will further drive the shift from Product-Centric to Patient-Centric portfolios.

Single-modality vendors will face an accelerated trend toward market exit or acquisition by larger, multi-modality, and integrated technology providers. Healthcare providers are moving toward integrated imaging ecosystems that support multiple modalities within a single, streamlined platform. Hospitals and diagnostic centres increasingly prefer multi-modality solutions for their efficiency, reduced operational costs, and ability to support comprehensive patient care. Single-modality vendors will struggle to meet this need without strategic partnerships or mergers.

Trend 4 – Imaging on The Go

Signify Research predicts advances in portable imaging, enabling clinicians to bring imaging directly to patients in various settings, including rural clinics, emergency rooms, more remote settings, improving patient access and reducing wait times. Additionally, AI-equipped point-of-care devices will help non-specialists make preliminary assessments and provide real time guidance, allowing for quicker intervention and treatment decisions, particularly in emerging and underserved areas. There will also be an expansion in the use of connected devices for real-time data sharing, remote monitoring and advanced image analysis.

Within the MRI market, there will be increased adoption of helium-free MRI solutions due to the compact, lightweight design, which will enable better installation in mobile units and healthcare providers to offer MRI services in remote or rural areas, improving patient access to diagnostics.

Screening programmes, particularly breast and lung cancer, could entail adoption of portable solutions such as mobile CT units, or mobile breast cancer screening trucks in order to encourage accessibility and participation.

In the ultrasound market, the development of handheld ultrasound devices has the potential to drastically expand ultrasound imaging to rural areas. In time this can even extend into the home. This is already being seen in some countries like Japan but can spread to other countries. It will negate the need for patients, particularly older patients, needing to travel long distances for appointments. The integration of AI will also enable less experienced users to perform the scans. As Ultrasound is increasingly adopted at the point of care, handheld ultrasound devices will be an attractive option for many healthcare workers in these departments. It will enable them to have their own device, which they can use on the go when assessing patients. The current workforce issues will also further drive adoption of easy-to-use handheld portable solutions that have additional features to help guide less experienced users.

Trend 5 – Modality Growth Overshadowed by Country Macroeconomics

The expansion of medical imaging modalities on a global basis will largely depend on each country’s economic and macroeconomic conditions. In 2025, the expansion of imaging modalities in regions such as Germany, the UK, and China will be heavily influenced by specific national dynamics. While Signify Research forecasts have accounted for current conditions as of 2024, there is a risk of unforeseen changes due to volatile conditions. For instance, potential escalations in the Middle East or shifts in international relations with the U.S., possibly influenced by policy decisions from the recently re-elected President Trump, could significantly impact these projections. The poor macro-economics seen in many countries in 2024 has led to purchasers becoming cautious. Many customers taking the “wait and see” approach to spending. As the economic situation improves, we project this to drive market growth. This is expected to continue through to 2025.

Click these links to view our other predictions for:

Digital Health | Clinical Care | Diagnostics and Life Sciences | Imaging IT and AI

Questions? Ask an Analyst

Contact our experts should you have any questions or would like a demonstration of our research capabilities:

Kelly Patrick Research Director | Lead on Medical Imaging Research Portfolio

Bhvita Jani Principal Analyst | CT/MRI, Molecular Imaging

Amy Thompson Research Manager | Imaging IT, AI in Medical Imaging

Mustafa Hassan, PhD Senior Analyst | Ultrasound

Aiyana Amess Market Analyst | Ultrasound

Phil Grainger Editor | Signify Premium Insights – Medical Imaging

Poornima Anil Senior Analyst | X-ray, Interventional X-Ray

Max Street Market Analyst | General Radiography & Fluoroscopy, Bone & Metabolic

Sarah-Jane James Market Analyst | Medical Imaging Yearbook

About the Medical Imaging Team

Signify Research’s Medical Imaging team formulates expert market intelligence for some of the leading Ultrasound, CT, MRI, and X-ray vendors. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Furthermore, our commitment to seeking a plurality of perspectives across the markets we cover guarantees that our insights remain independent and balanced.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences, Healthcare IT and AI in Healthcare.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.