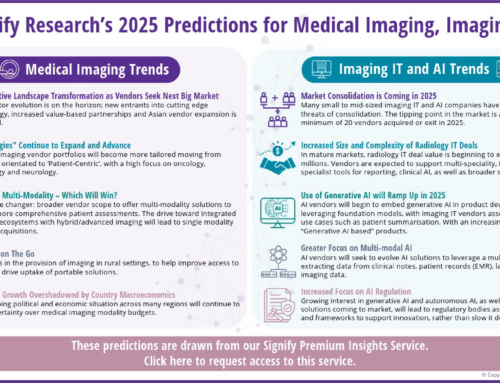

The Mobile C-Arm is on the Move

Turner Imaging Systems has ambitious growth plans to expand across Europe, enabled by the confirmation of the CE mark for the Smart C-Arm, adding to the FDA approval received in 2019. This is another step forward in the adoption of truly portable mobile C-Arm devices. Eventually, it is anticipated that this product, and other portable C-arms, will move some low-risk elective surgeries away from hospitals and other primary care centers, and closer to communities to increase access. The Turner Imaging Systems Smart C-arm is a battery-powered, low weight (7.3kg) mobile fluoroscopy and radiography device. Turner Imaging Systems is targeting surgical environments with the Smart C-arm, where the mobility of the product can allow for greater maneuverability and easier positioning within an operating theatre. Additionally, there are plans for use in clinics or diagnostic centers, military applications, sporting medicine and remote healthcare and humanitarian causes. Many of these applications are away from the traditional hospital-based surgical settings a C-arm is routinely used in.

Image: The portable Smart-C-arm x-ray imaging device (Photo courtesy of Turner Imaging Systems)

Surgery No Longer Just a Hospital-Based Procedure

One key trend expected to accelerate in the coming years will be moving procedures closer to rural communities which require access to such services the most. This transition is beginning to happen in general radiography, in facilities like malls or imaging centers. Although still in its infancy, until now, moving surgical X-rays out of traditional hospital settings has been rare.

This is evident with an increase in new outpatient and surgical centers being built in the United States. For example, in Gilbert, Arizona, a new 15,000 square foot center for surgical procedures opened in April 2021, with three operating rooms– equipped with Siemens Healthineers Cios Alpha Mobile C-Arm devices. This is housed in a disused Walmart neighborhood store. In the US market, more outpatient surgical centers are expected to open across the upcoming years.

In a vast country like the US, rural areas are often underserved with access to hospital facilities. This proves to be logistically challenging for populations living in such areas if minor surgeries and procedures are required and travelling to the nearest big city hospital may not be feasible, or transportation to the site may not be affordable.

This expansion of clinical settings where C-arms are used will be a stimulus for further sales of mobile C-arms creating new demand and opportunity. There is already a high penetration of mobile C-arms in developed countries within hospital settings – in 2019, just under 13,000 of the devices were sold globally, mostly to hospitals. However, new outpatient surgical centers located outside of hospitals are relatively untapped but have vast potential for future investment and sales. Whilst Turner Imaging Systems will naturally attempt to capitalize on this market, other vendors are expected to utilize this new space too. Such mobile C-arm vendors will look to partner with new surgical centers and become their preferred technology partners. At present, only a handful of vendors offer truly portable battery-powered solution. However, this is unlikely to impede the trend given that, for many surgical applications traditional mobile C-arms are still perfectly adequate.

However, the Turner Imaging Systems Smart C-Arm solution highlights unique attributes in areas where portability is required – for example in a sports environment. One case study is for imaging at a stadium, during the match. A complaint many sports physicians highlight is if a player gets injured in the game, they are effectively ruled out for the rest of the match until a thorough evaluation can be conducted post-match at a nearby hospital. If teams were to have a portable device that could be used pitch side, the extent of the injury could be assessed, with players potentially able to re-enter the game if cleared of breaks or serious injuries. This is another great example of bringing the imaging technology closer to those who need it the most and away from hospital environments.

Portability in the Wider X-ray Market

A truly portable X-ray system is not a new concept, however. The industry has been talking about handheld mobile X-ray systems, such as the Fujifilm Calneo Xair and the Oxos Micro-C for several years. These lightweight handheld devices can be easily moved, including within an operating theatre, compared to the larger more cumbersome X-ray devices. However, these devices have not yet received FDA approval, even after several years since launch. Typical use cases currently reside in Asia for the Calneo Xair, with plans to target developing countries. Without this approval, the lucrative surgical market cannot be exploited in the United States with such handheld solutions.

Signify has previously discussed another recent launch in the mini C-Arm market, the Adaptix 3D mini C-arm. This is not, however, a direct competitor to the Smart-C from Turner Imaging Systems. The Adaptix solution is not designed for surgical applications, instead is purely a point of care diagnostic tool for extremity imaging. Like the Turner Imaging Systems solution, the Adaptix solution also plans to take X-ray out of hospitals and into the communities, targeting medical and imaging centers, but offering 3D imaging with a shorter imaging processing time. The key to both Adaptix and Turner Imaging System’s envisioned plans is that they are aiming to create new markets, demand, and opportunities. Neither are aiming to erode the existing installed base in hospitals.

Being able to conduct surgeries in locations outside hospitals could help address procedural backlog for COVID-19 recovery. In the last year, elective surgeries have understandably slipped down priority lists, as hospitals diverted staff, resources and focus to fighting the pandemic. This has led to most countries having huge backlogs of patients waiting for their scheduled surgery. For example, the UK has an estimated backlog of 2.3m patients awaiting elective procedures, with many waiting over a year for basic operations. Likewise, Canada has 419,000 outstanding surgical procedures. This is similar in many other developed countries globally. It is expected to take several years to clear this backlog. One way the backlog can be alleviated is to take some of the pressure off hospitals and encourage patients to have their surgeries in other outpatient locations, such as in remote medical and surgical settings. Using solutions like the Turner Imaging Systems Smart-C (or other mobile C-Arms) outside of hospitals could therefore help clear some of this backlog.

Remote Surgical Centers Have Hurdles to Overcome.

Whilst the creation of non-traditional surgical centers has many benefits, there also remain key challenges that need to be overcome. Firstly, the biggest question that must be addressed is how surgical centers will be adequately staffed? As Signify Research outlined in the Insight assessing the prospect of diagnostic imaging in malls, the key problem here remains; in a market where there is already a national shortage of radiologists, how can enough radiologists be recruited to carry out the additional procedures in outpatient surgical centers? Not only radiologists are needed, but surgeons, doctors, and nurses too. With many hospitals being severely understaffed, this is a distinct challenge that must be addressed by healthcare providers.

Secondly, the cost of a portable mobile C-arm will be less than a traditional C-arm. Will the mainstream vendors invest time and resource in developing comparable products in a market that could be seen as a niche opportunity? It is possible that the existing technology will still be favored and promoted, rather than the high investment required in research and development associated with launching a new product. Conversely, the leading vendors may elect to develop portable systems and subsequently form partnerships with medical imaging and surgical chains once the product has traction in the market. This will be a potentially lucrative income stream. Also, purchasers tend to demonstrate high levels of brand loyalty. If other imaging devices (such as surgical X-ray or full C-arms) are being purchased from one major vendor, there is a high likelihood a portable mini C-arm will also be sourced from that vendor to assist with existing workflows. Brands with gaps in its product portfolio could miss out on larger multi-modality imaging deals i., if demand for portable C-arms increases

Questions also remain over the payment models centers will adopt. It is unknown how willing insurance companies will be to deal with smaller surgical centers as opposed to larger hospitals. Similarly in countries where there is a public health system, will the cost of procedures and imaging be covered in the same way it would be in a government hospital? However, this could open new payment models. Vendors like NanoX and Adaptix are exploring a cost per scan system, a move away from traditional payment methods. This could be an avenue the larger vendors choose to explore, creating a new income method from the usual hardware and software sales model.

The Times Are Changing

The days of all procedures and imaging having to happen in a traditional hospital environment are gone. Instead, moving services and medical procedures closer to the wider population is going to be the future.

Whilst there are, so far, a limited number of players in the portable mobile C-arm space it is thought that more vendors will enter this space. Signify expects the major players to all consider this option and potentially bring out products once the market has matured and is ripe for exploitation. However, at this point, this sector remains in its infancy. With new pay per scan payment models being a possibility, the key imaging providers would be wise to consider adding this as another string to the commercial bow. Turner Imaging Systems, along with brands like Adaptix are at the forefront of changing the location of remote imaging now, but at a relatively small scale. Larger vendors with the financial might and influence can bring this trend to a wider audience and drive a higher level of adoption, helping it to transition to a mass-market product. This will also happen as more surgical centers open and awareness builds.

Ultimately, Turner Imaging Systems may be paving the way, but for surgery in remote centers to really take hold, the companies with more clout will also need to follow.