Modern informatics solutions will drive revenue in developed markets as hospitals try to improve productivity and efficiency within imaging departments, finds Frost & Sullivan

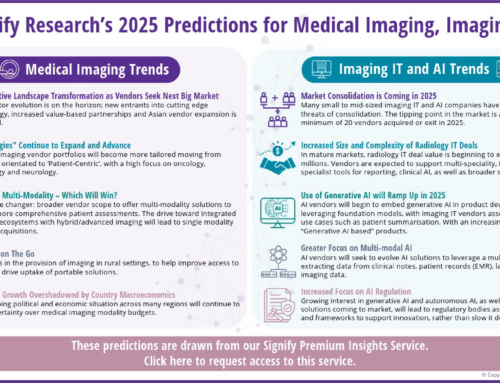

Frost & Sullivan’s recent analysis finds that the emergence of new technologies such as artificial intelligence (AI) and the cloud, evolving clinical and administrative/operational needs, and the introduction of new policies and regulations will boost the global medical imaging informatics market. This market—which comprises radiology IT solutions, ancillary IT solutions, other departmental IT solutions such as cardiovascular information systems, and enterprise imaging IT solutions—is estimated to hit $10.4 billion by 2025 from $8.5 billion in 2019, registering a compound annual growth rate (CAGR) of 3.5%. However, with the impact of COVID-19, the market will experience a slowdown in 2021 as hospitals delay investments in capital purchases and divert most funding to COVID-19 care. Still, it will bounce back in 2022 with higher growth rates due to the pent-up demand for IT purchases over the past two years.

“Medical imaging informatics is poised to play a central role in the intervention and management of illnesses. Digitization in imaging offers several advantages, including higher pixel information, efficient storage and retrieval, and ease in sharing images between the care team members,” said Suresh Kuppuswamy, Healthcare & Life Sciences Industry Principal at Frost & Sullivan. “Radiology IT is forecast to maintain its position as the largest revenue contributor, driven by the adoption of radiology PACS in emerging countries, as most of them are projected to still implement the PACS at the modality or departmental level.

Kuppuswamy added: “From a regional market viewpoint, the North American market will largely drive the enterprise imaging market, underscored by the need for clinical decision support systems and image exchange solutions. Europe, the Middle East, and Africa (EMEA) are expected to witness growth in ancillary and enterprise imaging segments. Similarly, China, Australia, Korea, and Japan are forecast to be the major economies spurring Asia-Pacific’s revenue growth. Continuous healthcare infrastructure improvements in Southeast Asia and India also provide additional growth opportunities for vendors.”

To tap growth prospects in the medical imaging and informatics market, vendors need to focus on the following:

- New opex business models to encourage small and medium hospitals to adopt modern informatics technology: Although opex models are mostly utilized in developed countries, the future potential is large in developing countries because the high demand for modern informatics solutions in these markets is constrained by the associated capital costs.

- Teleradiology to enable radiologists to work from home and increase their productivity: Create the necessary infrastructure for radiologists to work remotely without compromising quality and speed of work.

- AI integration into the imaging workflow to increase efficiency and quality of care: A large segment of the work is currently focused on modalities such as CT, MRI, and mammography. Algorithms can increase the accuracy and efficiency of radiologists in these areas.

- Unsustainable costs in healthcare to shift the focus on precision medicine and precision imaging: Ample opportunities exist for the imaging industry to further refine the imaging process by integrating innovative technologies along the imaging path, e.g., 3D camera at the point of acquisition to ensure centering is accurate and to avoid a repeat exam.

Digital Transformation in Imaging Powering the Next Wave of Growth in Informatics is the latest addition to Frost & Sullivan’s Healthcare & Life Sciences research and analyses available through the Frost & Sullivan Leadership Council, which helps organizations identify a continuous flow of growth opportunities to succeed in an unpredictable future.

For further information on this analysis, Digital Transformation in Imaging Powering the Next Wave of Growth in Informatics, please visit: http://frost.ly/5ch